Oil and gas companies face the same dilemma. But: how do they measure the thousands of barrels of crude oil & products moving through complex production, refining, pipeline and marketing systems? And: how much inventory is the “right” amount to have?

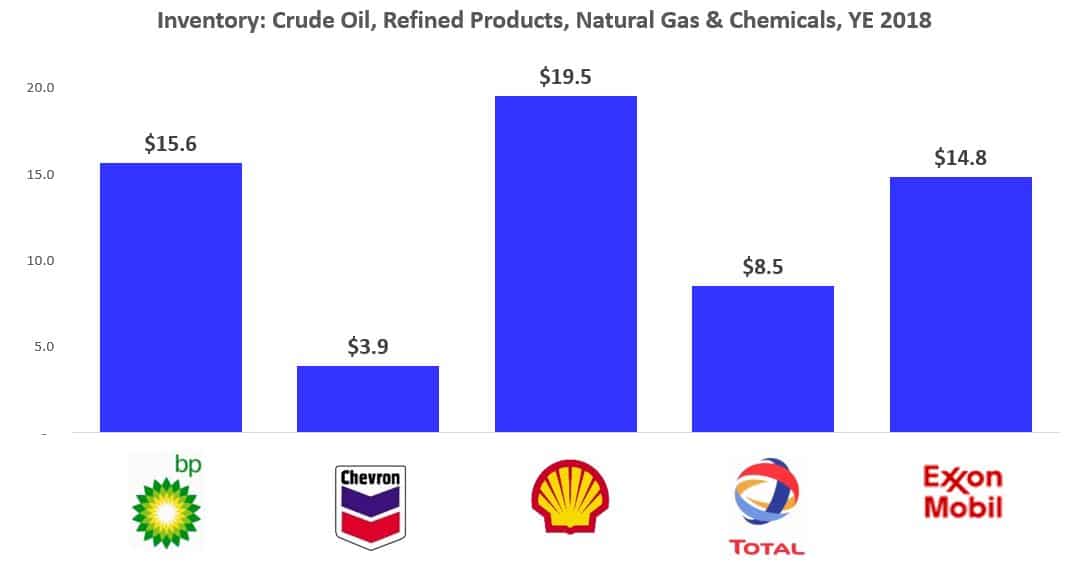

Yearend 2018 inventory values for selected integrated oil companies show wide variability:

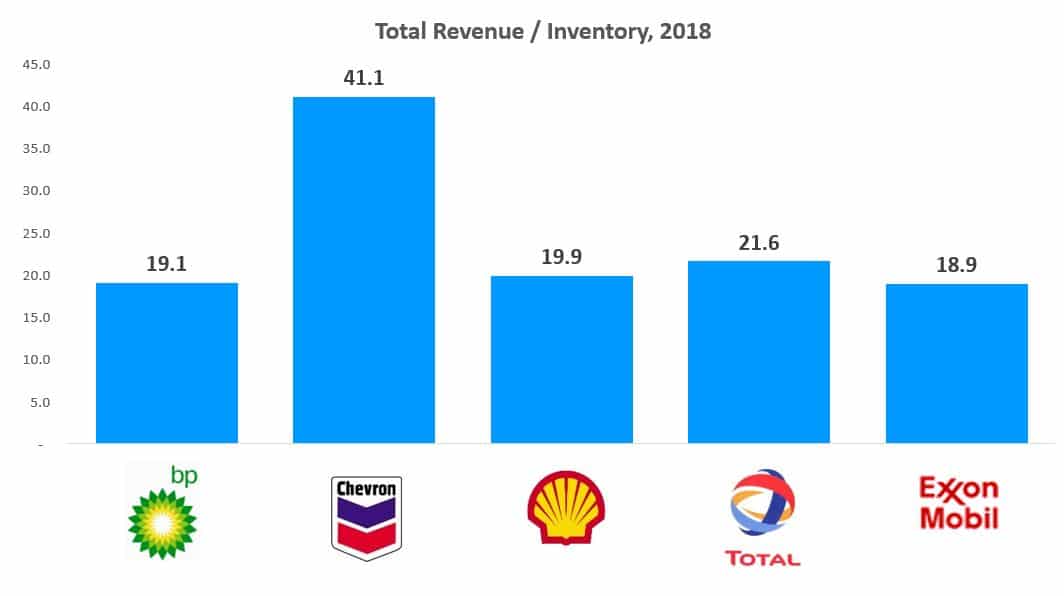

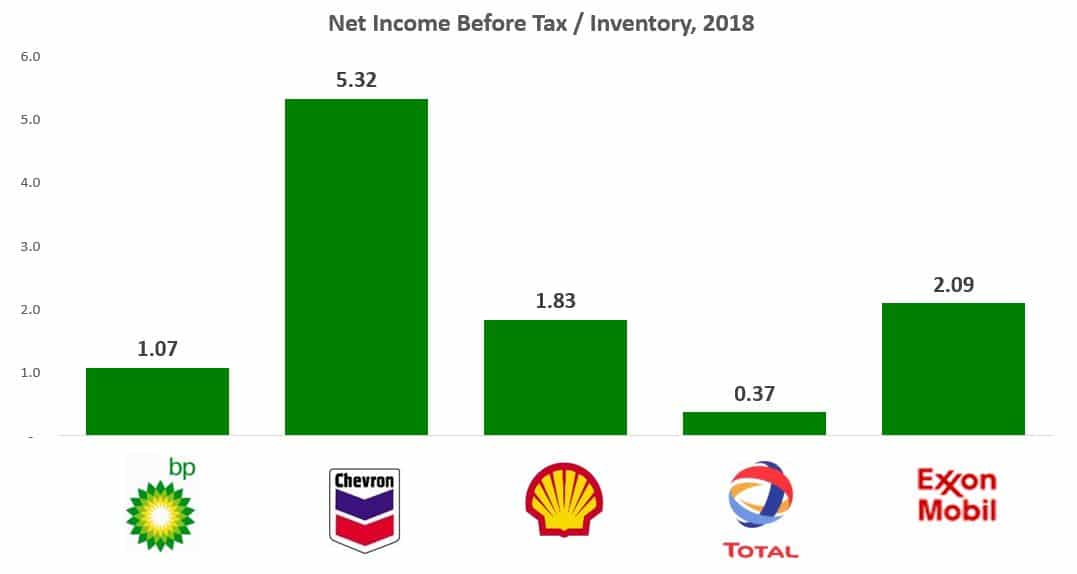

Each of these leading oil companies is unique, with wide differences in integration levels, international footprint, operational situation and historical factors, among other factors. However, besides indicating that Chevron is relatively efficient in its use of inventory compared to the other companies, it’s clear that all the oil companies struggle to understand: how much hydrocarbon inventory is enough, and how much is too much?

Bottom line: oil companies have billions of dollars tied up in inventory that could be better used in the business or returned to investors. Figuring out how much inventory they should be carrying is an ongoing challenge.