Oilfield Equipment & Services Experience

Our ability to understand and analyze numerous facets of the complex oilfield equipment and services space includes experience on dozens of projects.

A diversified, publicly traded corporation

specializing in the fabrication of specialized structures and vessels used in the oil, gas, & marine industries was involved in a project fabricating topsides with a company that filed for Chapter 11. The client asked us to assist them to understand their options regarding the partially completed topside units. We provided analysis of potential buyers of this unit, general indications of potential interest, and a preliminary assessment of how rapidly a potential buyer might be found and how long it would take to resolve the situation in general. This analysis helped the Client make informed business decisions as it entered bankruptcy negotiations as to the best way to realize value from the partially completed topside units.

An American subsidiary of one of Japan’s major integrated trading and investment business enterprises

looking to increase their market share in the pipe business engaged us to produce an acquisition analysis & review to help them develop a better understanding of the potential acquisition targets in the pipe and pipe-related markets, with a special focus on midstream and downstream areas. We reviewed the client’s strategy, current business, segmented the pipe market, reviewed the industry and provided acquisition analysis on targets based on the data. This study helped the client’s Tubular Products Group identify and research specific potential acquisition targets that could help it meets its aggressive growth targets during the next decade.

A premier private equity group

interested investing in a company that provides oil & gas staffing services engaged us to conduct commercial due diligence and review the markets in which the company operates. We prepared a Target Review where we identified and reviewed the primary drivers and leading indicators of the Target’s income and earnings growth. In addition we conducted a market review, client analysis, review of competitors, and provided a business plan review. The clients used this information to evaluate the growth potential and future success of their investment target.

A provider of subsea equipment and services

engaged us on a quarterly basis to provide an updated market review of the subsea hardware market globally. Each updated includes data on the current and historical market share for the subsea production equipment & installation services segmented by subsea trees, wellheads, controls, mudline wellheads, and trees; templates, manifolds and jumpers; PLETs and PLEMs; subsea flow boosting systems, separation systems, and flow metering; and installation services for the prior. We also provided figures for the other top 5 competitors in the market. The client used this information to assess their current market share and their position in the market.

A major manufacturer of comprehensive systems and components for the oil and gas industry

engaged to complete an FPSO market analysis project addressing whether the same types of integrated, standardized approaches the company has used in the drillship market will address the needs of the FPSO sector. Through analysis and interviews with market participants we tested several key business hypotheses related to FPSO project delays, leasing challenges, and potential for standardization. As a follow up to the project we developed additional content related to the findings and published a “white paper” on integration and standardization trends in the FPSO sector. These materials will help the client build its case with potential customers to develop FPSOs faster and more efficiently.

A leading, North American ship building company

investigating opportunities for future work identified the energy market as suitable for entry with specific focus on the offsite manufacturing and construction of engineered modules and commissioned us to sufficiently review and define the market for engineered modules. We conducted a complete review of the global market for downstream facility construction services and included a detailed examination of competitors in the construction space (both US-based and international), principal customers and supply chain analysis, providing critical strategic insight to the client. The client used this information when deciding whether to enter the market.

A private equity fund

asked us to analyze the turboexpander market, including the current installed base and replacement demand, future demand for turboexpanders in specific applications, and customer perspectives on selected turboexpander suppliers. The specific applications of interest include hydrocarbon processing, chemical processing, midstream gas processing (cryogenic separation), and LNG processing and production. We analyzed these applications as well as key suppliers in this space. Our client used the results of this analysis to help it determine whether and how to make additional private equity investments in the turboexpander segment.

An engineering firm

engaged us to analyze key growth strategies as it transitions from a smaller specialty firm to a much larger entity. It asked us to identify specific potential acquisition targets in this space as well as which market segments will provide the best growth opportunities during this timeframe, with an initial focus on LNG, oil and gas development, midstream, downstream and wind energy projects. The client used the results of this study to help it focus its acquisition efforts on particular energy sectors and identify specific acquisition opportunities. This will help it identify and acquire firms faster and achieve rapid and significant growth in equity value.

A manufacturer of fluid & metering technology systems for fluid handling applications around the world

engaged us to review the markets and commercial environment of the global Marine Terminals Oil & Gas Loading/Unloading equipment niche for loading arm and hose systems in which a target company operated. We provided an analysis of current and future demand for this equipment over the next several years based on key drivers such as trends in imports & exports of various fluid products, transportation methods used, marine terminal development and utilization trends, and other factors. We conducted research on the supply chain and analyzed customers, competitors, key suppliers, EPCs and related market segment participants. The company used the results of this study to determine whether and how it should purchase the target.

A private equity client

engaged us to analyze an investment in a helicopter transportation services provider to the oil and gas sector in Alaska. We analyzed the macro and micro drivers influencing the Alaskan oil and gas sector, especially as it relates to the helicopter business there. We provided an independent assessment of key economic fundamentals, underlying drivers and indicators, and an understanding of the key E&P operators in the area, especially after recent strategic moves and market exits by selected players. Our client used the results of this work to better evaluate whether and how it should invest in a helicopter services venture that will serve this market.

We completed a market forecast of overall demand for offshore vessels and subsea hardware for the oil & gas sector for a designer and builder of heavy construction equipment for the world’s leading onshore and offshore companies.

Our report included a five year demand forecast for offshore vessels and subsea hardware for the oil & gas sector as well as analysis of current crane capacity. The client used the results of this study to better understand current and future crane demand.

A Texas based Liftboat company

engaged us to provide industry insight and data regarding key infrastructure such as the existing population of fixed platforms in target regions in addition to relevant future projects. We covered the Arabian Gulf, West Coast African, Australia, Brazil, the Caspian Sea, the Gulf of Mexico, India, South East Asia, Malaysia and Venezuela and provided the platform name, operator, water depth, status, installation year, and size for platforms in each region. The client used this information to strategize their future growth strategy.

A large independent operator

needed information about specific countries regarding drilling rig availability, supply/demand, day rates, and other market intelligence related to the exploration sectors in these countries. The IOC needed this information in advance of actually entering the market in order to keep its plans confidential. The client used this information to help it enter and expand into new countries while more aware of drilling rig supply, demand, rates and availability in local markets. This helped the IOC’s business units improve their business success and profitability as they considered entering new markets.

A company that rents and services surface equipment to oilfield customers in several different US land basins –

in particular, natural gas fired generators mounted on trailers that deliver power to producing land wells and drill sites – seeking to better understand how its customers elect to power their drilling and production operations engaged us to provide an analysis of the space. The research included an in-depth analysis of customers, electrical utilities, competitors, and an economic analysis of the space. The client used the results of this work to better identify the most attractive potential customers and build a stronger business case to justify this power generation approach.

A private equity firm

considering whether and how to invest in a target that provides a variety of surveying, engineering, and permitting services to upstream energy clients engaged us to complete a phase 2 due diligence on the Target. In phase 2 we provided a further assessment of the Target’s business, client perception interviews, downside case analysis, and analysis of the Target’s competitive positioning. The client used the results of this study to inform their investment decision.

A private equity company

considering an investment in a provider of compliance employee certification services for refining, E&P, petrochemicals, and the refining industries asked us to provide a phase 1 assessment of the Target’s business, including an evaluation of its financial condition, review of industry drivers including those regarding employment and employee testing, operator perspectives on purchasing these services, and key risks to the business. The client used this information to determine whether and how to proceed to purchase an equity stake in the Target.

One of the world’s largest research and development organizations working with a client that manufactures and sells sensors for oil and gas applications

engaged us to provide a market research on the sensor industry. We conducted research on differentiation of the client’s products in the marketplace and provided an analysis of potentially unmet sensor needs in the energy market. The client used the results of this study to help their client improve its sales of sensors to the oil & gas markets, thus improving the client’s profitability and financial performance.

A private equity firm

looking to acquire a provider of engineered cryogenic equipment and services commissioned us to review the markets and commercial environment in which the Target operates. We provided a macroeconomic overview of the energy sector with a focus on LNG, natural gas, & industrial gas; overviewed the market; analyzed demand drivers; forecasted the LNG, natural gas, and industrial gas markets; and completed an analysis of customers and purchasers of the Target’s products & services. The client used this information to evaluate their decision to invest in the client and improve their understanding of the market conditions.

A company focused on responding to deepwater well control incidents

engaged us to provide a market analysis of the FPSO sector in support of a preliminary go/no-go decision on the viability of a specialized proposed FPSO configuration. We identified key drivers for offshore energy production market activity, identified and analyzed specific FPSO projects in the US Gulf of Mexico, Africa, & Brazil, analyzed key factors driving FPSO demand in the GoM and other regions, forecasted FPSO demand in the GoM, and provided initial recommendations on feasibility of the client’s FPSO concept based on the previous information. The client used this decision to evaluate how to best proceed with their concept.

We completed commercial due diligence analysis for a private equity firm

interested in acquiring a target company, a leading provider of electrical & instrumentation and transmission & distribution services to the North American energy infrastructure market. The client needed additional information regarding the target’s current strategy, product demand drivers, position with current clients, sector competitive position and intensity, supplier relationships, and service offerings. The information helped the client develop an informed view of the value of the target and helped it as it considered whether and how to make an offer to the target.

A manufacturer of highly engineered critical components and customized technology solutions for the energy, transportation, and industrial markets

in the final stages of a commercial due diligence for a valve manufacturer engaged us to provide additional information on the Target’s competitive environment, ability to defend its market, brand, and market position. The client used this information to evaluate how to best proceed strategically in an increasingly competitive market and whether purchasing the Target would be the best next step.

A leading global investment firm

interested in acquiring an industrial sealings company asked us to perform a market & commercial analysis of the OEM market. The research entailed a review of the market for custom-based consumables, well service packings, frac balls & sidewinders, urethane blended valves and their market within the US and internationally. This due diligence had a particular focus on material preferences as they varied by US unconventional basin. The client used this information to inform their investment strategy.

A large North American private equity firm

engaged us to evaluate the proppant market in the US oil and gas sector. In particular, it seeks to understand how customers select, specify and purchase proppant; whether and how proppant usage varies by basin, field and/or operator, and what factors drive the purchase decision, among others. It would like to understand the key drivers behind proppant demand, how proppants compare to one another, and the key logistics issues related to proppant supply. The client the results of this analysis to better understand whether and how changes in energy markets and commodity price levels affect proppant markets, allowing it to make better decisions regarding current and potential future private equity investments in this space.

A company which provides integrated corporate communications and other related services to clients in the energy industry

engaged us to assist their client in improving their understanding of the training market in the oil and gas sector. Our analysis included a qualitative survey of the training market for the oil and gas industry substantiated by interviews with key market participants. Our client used our research to understand its opportunities within the industry.

A leading manufacturer of comprehensive systems and components for the oil and gas industry

asked us to lead and facilitate an industry roundtable discussion with key customers, developers, engineers, equipment suppliers, and others active in the FPSO market resulting from an analysis of the FPSO market we completed for the manufacturer. Our discussion involved a review of the key findings of our industry whitepaper which outlined the market as well as an assessment of the company’s recent projects and a discussion of proposed hypotheses on more efficient development of selected projects. The client used the results of this facilitated discussion to better understand the perspectives of various participants and to develop better relationships with potential customers.

An international provider of equipment and oil field services to the energy industry

seeking an independent third-party review of the land rig market to support business planning decisions engaged us to provide a database and report of the space. The report included data on the five-year rig construction/upgrade market forecast, data on the existing fleet by region, a breakdown of operating companies, an overview of the competitive landscape, and an outline of the purchasing drivers and rig attributes. The client used this information to assess their market positioning and evaluate their market strategy.

A private equity firm

with limited experience in the energy sector pursuing a potential acquisition of a provider of survey engineering and permitting services engaged us to review the markets and commercial environment in which the Target operates. In Phase I of the project we provided an initial assessment of the Target’s business, analysis of the Target’s current and forecast market share, an independent point of view on customer concentration and customer stickiness, key business and industry risks, and other potential headwinds to the business. The client used the results of this Phase 1 analysis to determine whether and how to proceed to purchase an equity stake in Target.

A private equity firm

focused on small and middle market operating companies involved with a potential acquisition of a manufacturer of parts for plunger pumps engaged us to provide buy side due diligence related to the acquisition. We provided an assessment of the Target’s business in the plunger pump sector and the pump parts manufacturing space including details on market drivers, key competitors, customer purchasing decisions and behavior, and other factors. We also overviewed the Target’s current and forecast market share, key business and industry risks, competitive landscape and differentiation, customer analysis, the supply chain, and other relevant factors. The client used the results of this Phase 1 analysis to determine whether and how to proceed to purchase an equity stake in the Target.

A rig contractor with a large fleet of standard specification jackups

interested in entering the Mexican market engaged us to develop a white paper highlighting the uses and benefits of standard class specification drilling equipment. The white paper included a discussion of the benefits of standard specification jackup rigs and how they are uniquely suited to the needs of NOC Petrobras. The client will use the white paper as part of its marketing approach to use in business development and sales activities that support its business model. This will help it better identify specific customer opportunities and lead to increased sales and financial performance.

An American global aerospace, defense, security, and advanced Technology Company

interested in obtaining market intelligence engaged us to research the Subsea Market. Our report outlined principle drivers in the Subsea IRM sector, offshore pipelines, fixed platforms, floating platforms, and subsea wellstock. We also analyzed subsea IRM Market Demand broken down by vessel days and information on total vessel days, total market size, total vessel demand, and installed infrastructure base. The client used this information when reviewing their current business plans and models.

A large crane manufacturer

engaged us to review the floating production system (“FPS”) market in Brazil. The client manufactures a range of equipment (cranes, winches, anchor handling etc.) for floating production systems such as FPSO’s. We developed a detailed forecast of activity in this space, including project-by-project updates. The client used the results of this work to improve its forecast of equipment sales from its South American facility, thus leading to higher operating income in this business segment.

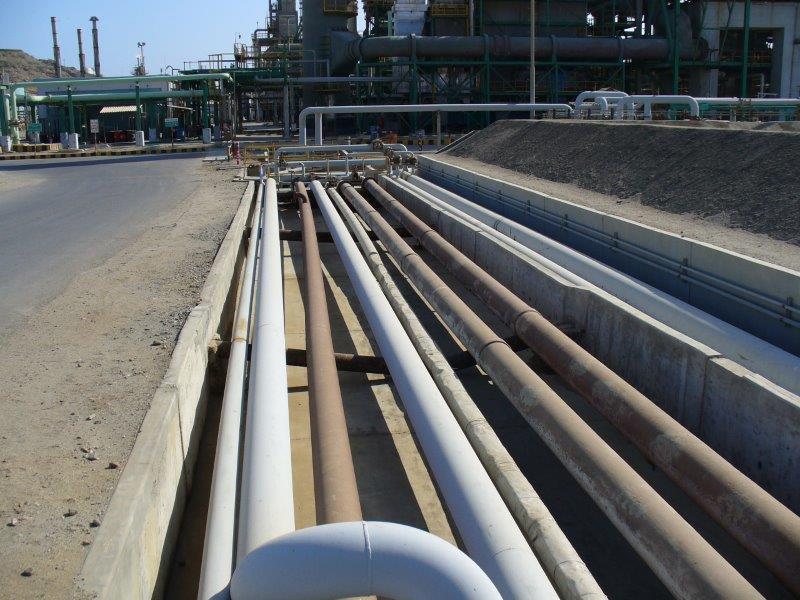

A manufacturer of high performance pumps and superior safety critical equipment to energy customers around the globe

seeking an update of selected data related to the Middle East engaged us to provide the needed market review. We focused solely on the Middle East markets and provided information on the Pressure Controls, OCTG, Turbomachinery, Centrifugal Pumps, Flow Control, Downhole tools, and O&M sectors and their applications in the Drilling & Completion, Production, Transportation, Refining, Power, and Sewage markets. The company used the results of this study to better plan its activities in the Middle East and improve revenues and operating margin there.

A leading coatings and specialty products company

who served some oil field services companies and wished to grow and develop in these markets asked us to complete a market analysis to help them better understand these market segments as it considered whether and how to devote additional resources to its OFS clients. Our review included a breakdown of the various elements of the OFS sectors and analysis of industry forecasts and drivers and important market trends. Our analysis enabled the client to understand how their coatings may be needed in various energy-related applications.

A manufacturer of fluid & metering technology systems for fluid handling applications around the world

engaged us to review the markets and commercial environment in which the company operates in order to determine if they should purchase a manufacturer of loading arms and hose systems. We addressed key questions related to technology, degree of differentiation, pricing differentials, pricing positioning, competitive position, among other topics. The company will use the results of this study to determine whether and how it should purchase the target.

A manufacturer of components for heat tracing tanks & instrumentation

investigating two additional applications for heat tracing – as a downhole heating solution to improve flow rates from producing oil wells and as a heating application for subsea gathering flowlines to reduce hydrate formation and increase fluid flow – commissioned us to provide an objective assessment of the likely demand for these products and how end customers might value them. We interviewed key potential customers, estimated of the number of onshore and offshore wells that might need these types of heating products, and reviewed current technologies available in the market place. The client used the results of this study to determine whether and how much demand exists for these heating approaches.

A provider of oilfield services in North America,

which recently purchased stakes in three separate firms that provide machining and manufacturing services to the energy industry, engaged us to provide analysis of the precision tool and premium parts markets and help them develop a business plan and strategy for the next five years. Our study helped the Company understand the market potential for its goods and services and how this potential might evolve over the next five years. The company used the results of our report to improve upon its strategy, its market penetration, the range of services provided, and increase revenues and operating income over the next years.

A leading worldwide provider of equipment and components used in oil & gas drilling and production services and other oilfield services

asked us to conduct a market review and analysis of floating production systems market. We reviewed the current FPSO supply chain, recent FPSO project history, and assessed future development options for FPSOs. The engagement helped our client understand the current state of the floating production, storage, and offloading vessels (FPSO) market, identify specific areas where it is currently underperforming and/or inefficient, and determine whether an alternative method of delivering FPSOs on a more-standardized basis will be attractive to operators and other market participants.

Our large oilfield services client

needed to plan and justify a significant manufacturing capacity expansion. Led efforts to quantify the client’s current casing equipment capacity, forecast future product demand, and develop strategies to most effectively meet that new demand. Used a detailed supply chain model to predict precise capacity needs on an individual machine workstation and raw material supplier basis. Led efforts to plan the move of the client’s existing technology center, including hiring and training new people and creating the right methods to transfer extensive product knowledge. The client used the results of this work to justify construction of a new $100+ million manufacturing plant.

One of the world’s leading oilfield equipment suppliers

needed to understand whether and how to increase drill bit production capacity. Our analysis helped justify and plan a new drill bit manufacturing facility in the Far East. Our work analyzed economic returns, key risks, staffing plans, site selection, and procurement issues to ensure project success. The client used the results of the work to move forward on a 25 percent expansion of its global production capacity for this tool category.

Our client, a large oilfield tools manufacturer,

needed help assessing the health, safety and environmental and quality aspects of a major manufacturing capacity expansion. Worked closely with subject matter experts in these areas to integrate these efforts more fully into the $300+ million capital expansion. The client used the results of this work to fully shape the quality and HSE aspects of the manufacturing expansion program.

Developed a detailed risk assessment for an oilfield tool manufacturer’s plans to build new plants and shift existing production to different facilities.

Created and implemented a method for collecting, analyzing, prioritizing and summarizing key risks, and developed risk mitigation strategies for relevant risks. Created RFP for new manufacturing facility construction. Developed and presented key deliverables to client. The client used the results of the risk assessment and other analyses to support its plans to significantly reshape its worldwide manufacturing assets.

Helped a major oil company

develop a sourcing strategy for the procurement of construction, maintenance and engineering services. The effort involved in-depth work with a client team across several different and unrelated divisions of the organization. The client used the results of the study to realize $10+ million of annual procurement savings.